Why Holder Distribution Matters in Crypto

When you look at a new coin, price is not the only thing that matters. “Holder distribution” is a simple but important idea: it shows how the supply of a coin is spread across different wallets. Understanding holder distribution can help you spot risk, hype, and potential red flags.

What Is Holder Distribution?

Holder distribution describes who owns the token supply and how concentrated it is. It answers questions like:

How many wallets hold the coin?

How much does each wallet own?

Do a few big wallets control most of the supply?

If a small number of wallets hold a huge share, the coin is highly concentrated. If many wallets hold similar amounts, ownership is more spread out.

Why Concentration Matters

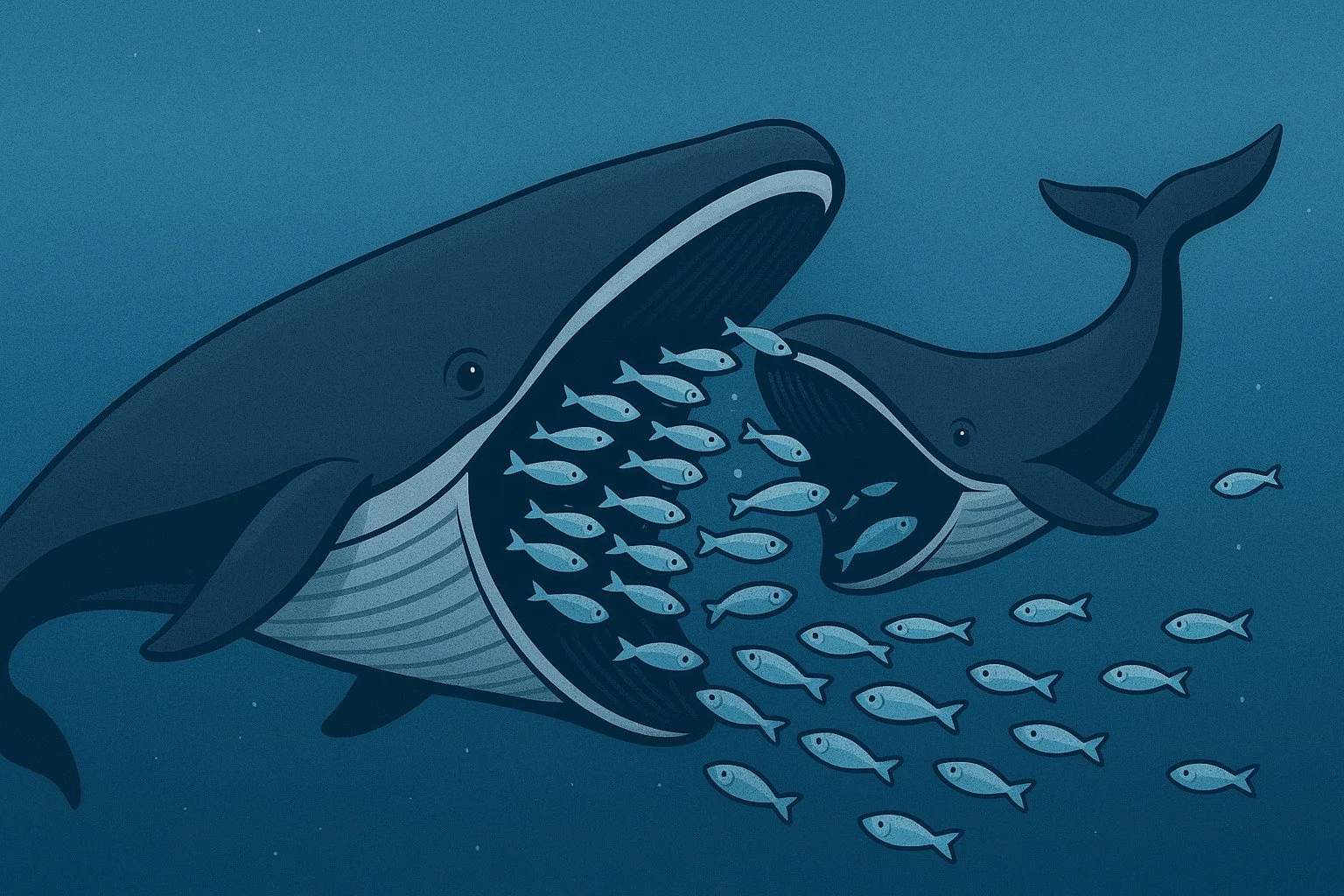

When a few “whale” wallets (very large holders) control a lot of tokens, they can move the market.

High concentration can mean:

One big sell can cause a sharp price drop.

Whales may have outsized influence on community votes or project direction.

New buyers may be entering at a disadvantage if insiders hold most of the supply.

More spread-out ownership does not guarantee safety. It can still be volatile. But it reduces the chance that one or two wallets can crash the price on their own.

Liquidity, Selling Pressure, and Unlocks

Holder distribution also affects liquidity (how easy it is to trade without big price swings).

Things to watch:

Are many tokens sitting in a few team or investor wallets that will unlock later?

Is a large share in one exchange wallet, where it can be sold quickly?

Are tokens spread across many real users and long-term holders?

When big wallets unlock or move coins to exchanges, it can increase selling pressure and hurt late buyers.

Governance and Community Power

In some projects, tokens are used for governance. Holders vote on changes, upgrades, or how treasury funds are used.

If a few wallets hold most of the voting power:

Decisions may favor insiders over regular users.

Community input can be limited, even if many small holders care about the project.

A more balanced holder distribution can support healthier, more resilient communities.

Practical Questions to Ask

Before getting involved with a token, you can ask:

How much of the supply is in the top 10 or 100 wallets?

How much is held by the team, early investors, or a treasury?

Are there clear schedules for token unlocks or vesting?

Does the project explain its holder distribution and address risks?

These questions do not give guarantees, but they can protect you from obvious concentration risks.

Takeaway

Holder distribution shows how power and risk are divided in a crypto project. Heavy concentration in a few wallets can mean more risk of sudden dumps and insider control. Spread-out ownership can support healthier markets, but you still need to do your homework. Look beyond price charts, study who actually holds the tokens, and move slowly before committing serious money.

Not financial advice. Educational purposes only.