Crypto Investing for Beginners

Click the buttons below for specific topics on crypto investing!

What Are Stablecoins in Crypto?

Learn how fiat-backed, crypto-backed, and algorithmic stablecoins work, why they matter, and the key risks beginners should know.

Liquidity vs Volatility in Crypto: How They Interact

Learn how low liquidity can increase volatility, why they feed into each other, and what that means for beginner traders.

Phishing in Crypto: What Beginners Need to Know

Learn how fake sites, support scams, and airdrop tricks steal wallets and simple steps to avoid common attacks.

Leverage in Crypto: Why It Magnifies Both Gains and Losses

Learn how margin and liquidation work, and why leverage multiplies both gains and losses for beginner crypto traders.

Why Crypto Feels More Emotional Than Other Assets

See how volatility, 24/7 markets, social media, and self-custody make crypto especially intense.

Web2 vs Web3: What’s the Difference?

Learn how today’s internet compares to Web3, with blockchains, wallets, and user ownership, plus key risks for beginners.

FOMO, FUD & Bagholding in Crypto

Learn how these common crypto emotions can hurt beginners and simple ways to make calmer decisions.

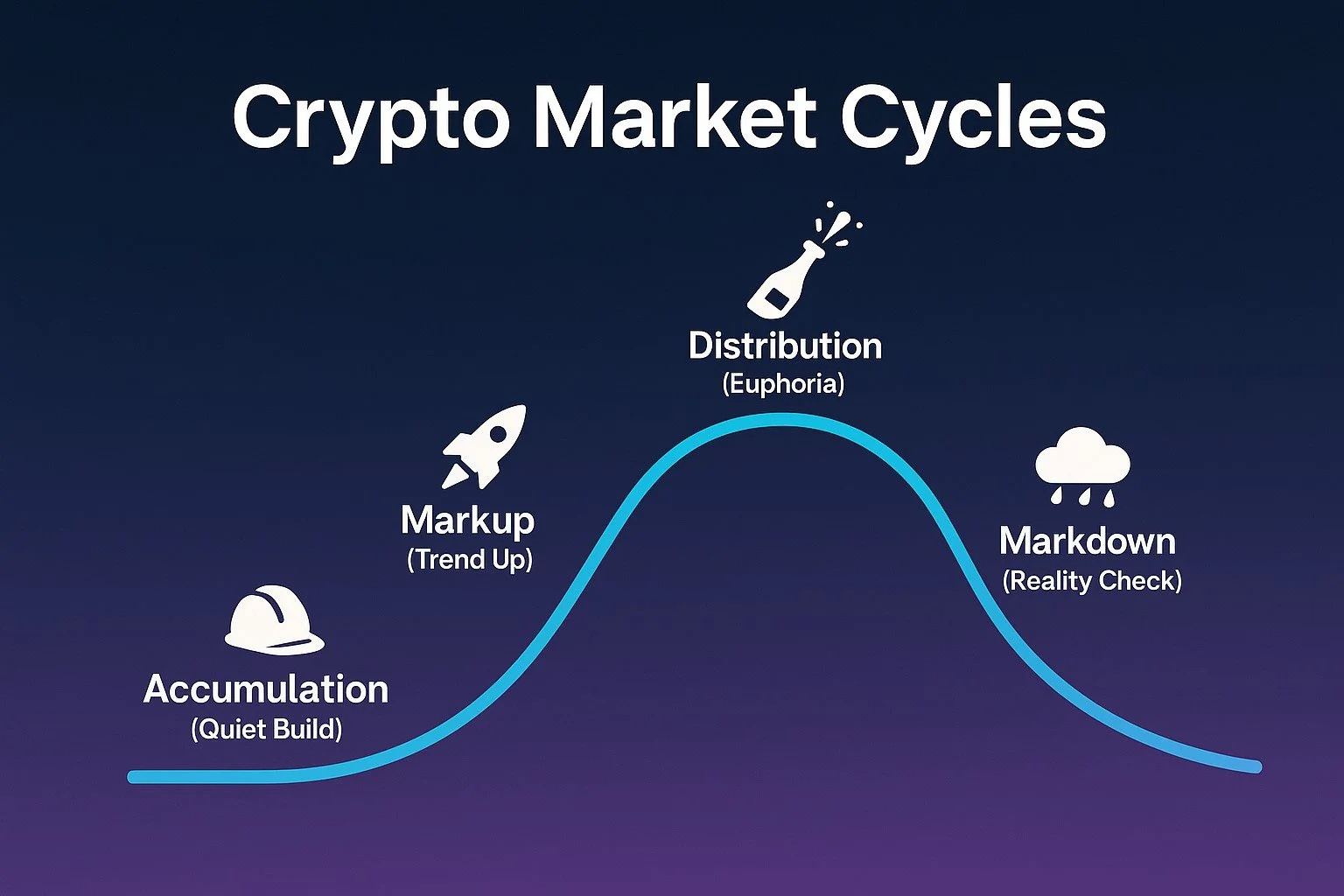

Understanding Crypto Market Cycles

Learn how bull and bear markets, emotions, and phases like accumulation shape long-term crypto price moves.

Crypto Volatility

Learn why crypto prices move so fast, the risks and opportunities of big price swings, and simple steps beginners can take to manage risk.

What Is Token Burning in Crypto?

Learn how token burns work, why projects use them to reduce supply, and why burning is not a magic fix for weak demand.

What Are Gas Fees in Crypto?

Learn what gas fees are, why they change, and how to save money when sending or trading coins.

What Is Liquidity in Crypto?

Learn how liquidity, slippage, and liquidity pools affect how easily you can trade coins and the risks of low-liquidity tokens.

What Is Slippage in Crypto?

Learn why your actual trade price can differ from the quote, how slippage tolerance works, and simple ways to reduce hidden costs.

Market Cap vs FDV in Crypto

Learn what each number means, how circulating vs max supply differ, and why big gaps can signal future dilution risk.

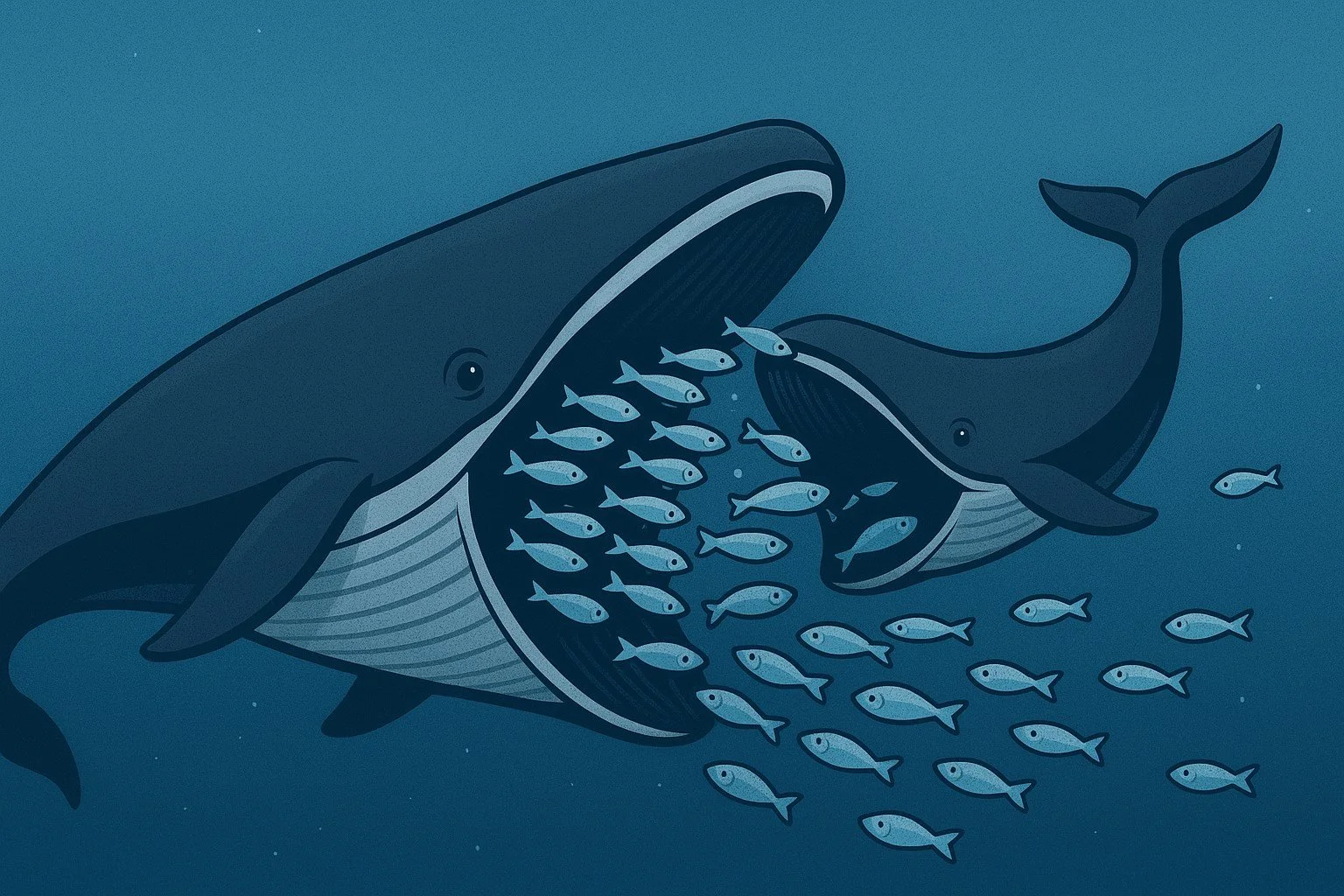

Why Holder Distribution Matters in Crypto

See how whale wallets, token ownership concentration, and unlocks can affect risk, price moves, and governance.

Crypto Market Cap: What It Is and Why It Matters

Learn how market cap, circulating supply, and fully diluted value help you compare coins beyond just price.

Crypto Investing Safely and Securely

Learn crypto safety: avoid phishing, rug pulls, fake support DMs, and risky signatures. Protect your seed phrase before you connect a wallet.

Crypto, Altcoin, Memecoin: What’s the Difference?

Crypto vs altcoin vs memecoin explained in plain English. Learn the key differences, use cases, and risks of each type of coin as a new crypto investor.

How to Verify a Token Contract Is the Real One

Verify a token’s real contract address on Solana using official links, explorer checks (Solscan/SolanaFM), and DEX searches to avoid look-alike scams.

Private Key vs Seed Phrase vs Password

Learn how private keys, seed phrases, and passwords work in crypto wallets and what you must protect to keep coins safe.